Governance Initiatives

- Home

- ESG Initiatives

- Governance Initiatives

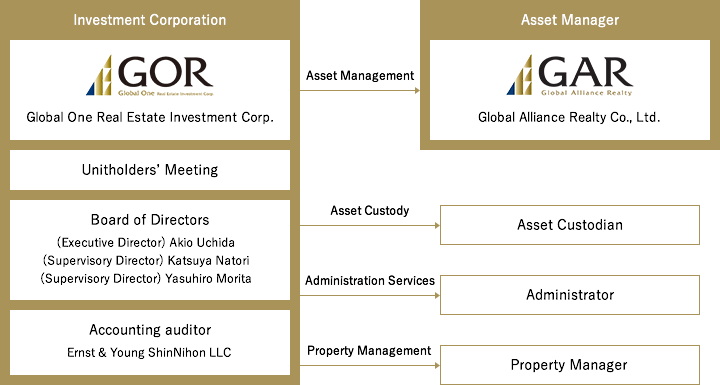

Business Structure of GOR

Organization for operating GOR is composed of one Executive Director, two Supervisory Directors, a Board of Directors whose constituent members are the Executive Director and the Supervisory Directors, as well as the external independent auditors, in addition to the Unitholders’ Meeting composed of the unitholders.

- Based on the Act on Investment Trusts and Investment Corporations (“the Investment Trusts Act”) and Articles of Incorporation of GOR, the number of Supervisory Directors must be at least the number arrived at by adding 1 to the number of Executive Directors.

- Investment corporations are legally restricted from having employees and as such, they are required to entrust operations to external parties.

Status and Term of Office of Executive Director and Supervisory Directors

Please refer to the linked page for the status of Executive Director and Supervisory Directors.

https://www.go-reit.co.jp/en/about/officers.html

Stipulated in the Articles of Incorporation, the term of office for both Executive Director and Supervisory Directors is two years* from taking office.

- The term of office might be extended or shortened based on a resolution made at a Unitholders’ Meeting to the extent stipulated in laws and regulations.

Criteria for Electing Executive Director and Supervisory Director

Candidates for director are selected for the reasons below upon approval at the general meeting of unitholders, assuming that reasons for disqualification stipulated in the Investment Trusts Act and other laws and regulations (Articles 98 and 100 of the Investment Trusts and Article 244 of the Ordinance for Enforcement of the Investment Trusts) do not apply. The current directors are outside experts who have no special interest in GOR.

| Title | Name | Reason For Appointment | Gender | Attendance at Board of Directors (FY2024) |

|---|---|---|---|---|

| Executive Director | Akio Uchida | Business experience in the real estate field and other factors. | Male | 100%(16 times/16 times) |

| Supervisory Director | Katsuya Natori | Expected exercising of technical knowledge as an attorney. | Male | 100%(16 times/16 times) |

| Supervisory Director | Yasuhiro Morita | Expected exercising of technical knowledge as a certified public accountant, tax accountant and real estate appraiser. | Male | 100%(16 times/16 times) |

Compensation for Executive Director and Supervisory Directors

As for the compensation for the Executive Director and Supervisory Directors, the amount shall be no more than 800,000 yen per month for each Executive Director and no more than 500,000 yen per month for each Supervisory Director, and shall be the amount determined by the Board of Directors, to the extent not larger than the above-mentioned amount, respectively, after taking into consideration the compensation levels for an executive director and a supervisory director in an investment corporation other than GOR and the compensation levels for directors and auditors who are engaged in similar assignments as the concerned assignments in corporations and other entities as well as compensation levels for officers in other entities, etc., general price trends, wage trends and other economic indices. Said amount shall be paid by no later than the last day of each month (Article 19 of the Articles of Incorporation).

| Title | Name | Total compensation amount(thousand yen) | ||

|---|---|---|---|---|

| FY2022 | FY2023 | FY2024 | ||

| Executive Director | Akio Uchida | 6,084 | 6,084 | 6,084 |

| Supervisory Director | Katsuya Natori | 4,860 | 4,860 | 4,860 |

| Supervisory Director | Yasuhiro Morita | 4,860 | 4,860 | 4,860 |

Compensation for Accounting Auditor

As for the compensation for the accounting auditor, the amount shall be no more than 15 million yen for each fiscal period that is subject to audit, and shall be the amount determined by the Board of Directors, to the extent not larger than the above-mentioned amount, after taking into considerations the compensation levels for an accounting auditor in an investment corporation other than GOR and the compensation levels for accounting auditors, etc. who are engaged in similar assignments as the concerned assignments for corporations and other entities, as well as general price trends, wage trends and other economic indices. Said amount shall be paid within one month from the end of the month during which GOR receives all the audit reports required by the Investment Trusts Act and other laws and regulations (Article 19 of the Articles of Incorporation).

| Title | Name | Total compensation amount(thousand yen) | ||

|---|---|---|---|---|

| FY2022 | FY2023 | FY2024 | ||

| Accounting Auditor | Ernst & Young ShinNihon LLC | 30,900 | 27,600 | 27,600 |

Management Structure

GOR entrusts management of its assets entirely to GAR. GAR manages assets of GOR in accordance with the asset management agreement executed between GOR and GAR.

GAR is entrusted with operations for asset management and management advisory from GOR and real estate funds, etc. other than GOR.

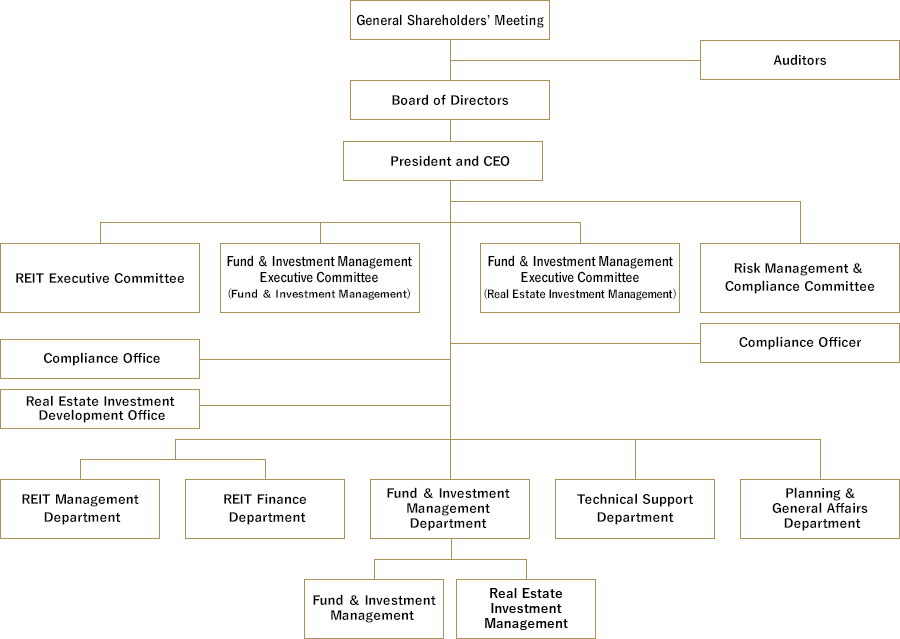

Organizational structure of GAR is as indicated below.

Overview of GAR’s Committees and Departments Related to GOR

| Name of Committee/Department | Outline of the Operations |

|---|---|

| REIT Executive Committee | Deliberation and decision of basic matters, important matters, etc. on the asset management operations for investment corporations Assessment and management of results and status on asset management for investment corporations |

| Risk Management & Compliance Committee | Deliberation and decision of basic matters, important matters, etc. on the risk management and compliance Risk management for daily operations and post-confirmation of status check on compliance with laws and regulations, etc. |

| REIT Management Department | Establishment and implementation of management policies/plans on assets of investment corporations Due diligence on asset acquisitions/transfer by investment corporations Selection, control, and supervision of property managers |

| REIT Finance Department | Provision of advice on fund procurement and cash distributions for investment corporations Provision of advice on establishment of basic policies/plans related to information disclosure by investment corporations Management of assets other than real estate, etc. for investment corporations Overseeing accounting operations on assets of investment corporations |

| Technical Support Department | Research and technical support on real estate management control Research on economic trends and real estate markets |

| Real Estate Investment Development Office | Collection, provision and management of investment information on real estate, etc. Implementation or support on advice for acquisition of real estate, etc. (including due diligence) Real estate market research for investment on real estate, etc. |

| Planning & General Affairs Department | Planning and drawing up plans for overall management of GAR as well as operation of the Shareholders’ Meeting and Board of Directors’ Meeting Items concerning personnel affairs, labor affairs, general affairs and accounting of GAR as well as overall finance, information disclosure, public relations and advertisement |

| Compliance Office | Item related to compliance and risk management |

Fee for Asset Manager

Based on the Articles of Incorporation and the asset management agreement, GOR has set that management fees to be paid to GAR shall be comprised of those linked to the previous term-end total assets and those linked to net income. GOR believes that linking part of the management fees to the net income will create incentive for GAR to improve GOR unitholders’ value.

| Asset Management fees | |

|---|---|

| Asset Management fee 1 | Previous term-end total assets × 0.3% per annum |

| Asset Management fee 2 | Profit before tax based on asset management fee 2 for the relevant fiscal term(*) × 5.0% |

- Profit before tax based on asset management fee 2 for the relevant fiscal term = operating revenue – operating expenses (excluding asset management fee 2) + non-operating profits and losses

| Acquisition / Transfer fee | |

|---|---|

| Acquisition fee | Acquisition cost (appraisal value of the Real Estate-Related Asset acquired in the case of acquisition through asset replacement) × 0.5% |

| Transfer fee | Transfer value (the appraisal value of the Real Estate-Related Assets transfered in the case of transfer through asset replacement) × 0.5% |

- Excluding acquisition / transfer through a merger

| Merger fee | |

|---|---|

| Merger fee | The amount seperately agreed upon with the Asset Manager on the effective date of the merger up to the amount equivalent to 0.5% of the total appraisal value of the counterparty's real estate related assets succeeded and owned after the merger |

Same Boat Investment by GAR

GAR holds GOR’s investment units through same boat investment. With GAR holding GOR’s investment units, sharing of interest between GOR’s unitholders and GAR will be promoted in an aim to improve unitholder value of GOR over the medium term.

| Number of GOR’s investment units held by GAR (as of 30 Sep. 2025) |

10,000units 1.02% of the number of investment units issued and outstanding |

|---|

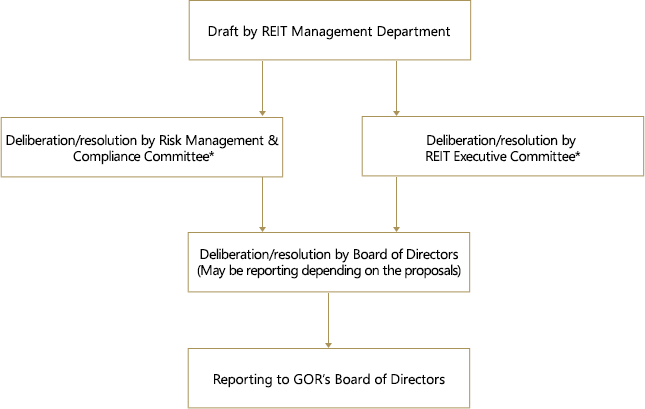

Investment Decision-Making Rules for Asset Acquisition and Other Asset Management

- If the President of the Asset Management Company, who is the chairman of REIT Finance Department Executive Committee and the Risk and Compliance Committee, does not agree with the resolution from a managerial standpoint, the resolution shall be deemed to be rejected.

In addition Compliance Officer may veto the resolution if any compliance issues are identified.

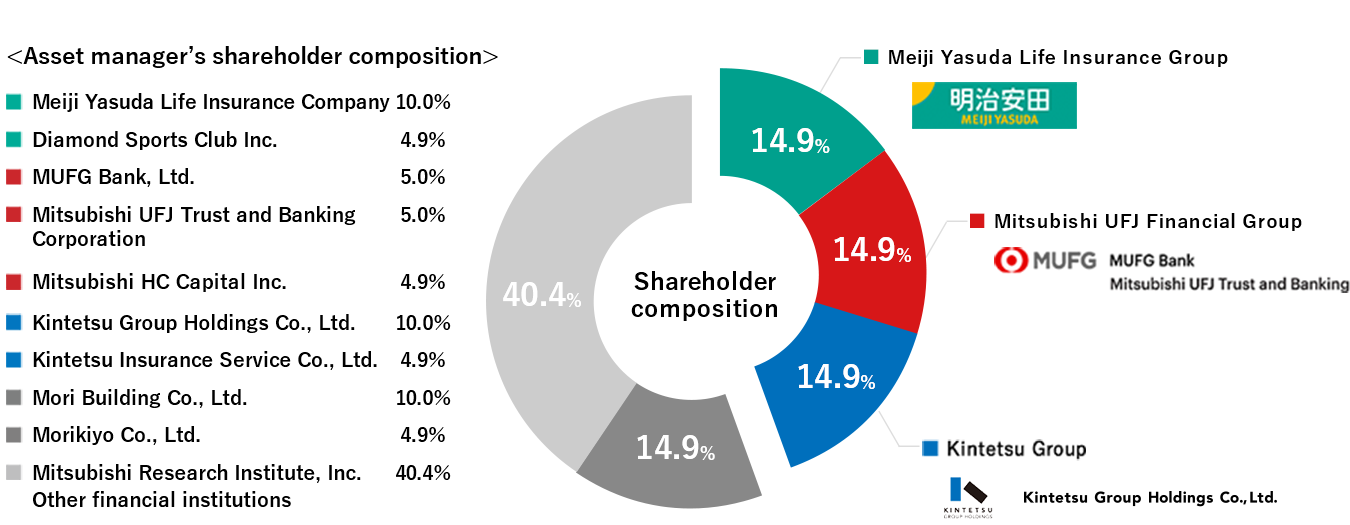

Eliminate Conflict of Interest

GAR does not belong to any of the sponsor groups and thus has realized the structure in which mutual warning takes effect and intention of a certain group will not be adopted unilaterally.

- Regarding Diamond Sports Club Inc., Meiji Yasuda Life Insurance Company only has a 5% stake in it. However, since the company falls under the category of a “close party” in the corporate accounting standards given its personnel relationship, etc., it is treated as a party that belongs to the Meiji Yasuda Life Insurance Group.

For details of the Governance Initiatives, please refer to the GAR’s website.

https://www.go-reit.co.jp/en/esg/governance.html