Green Finance

- Home

- ESG Initiatives

- Green Finance

With the escalation of environmental challenges such as climate change and air pollution in recent years, how to procure funds to deal with such problems has become an issue.

Financing for investment to solve environmental issues is called green finance, and GOR will contribute to realizing a sustainable environment and society through green finance.

Green Finance Framework

GOR has established a "Green Finance Framework" (the "Framework") for the implementation of green finance.

GOR also received Green 1(F) rating, which is the highest evaluation in the “JCR Green Finance Framework Evaluation” of Japan Credit Rating Agency, Ltd. ("JCR").

Use of Funds Procured

GOR uses the funds procured through green finance for new investment or the refinancing of investment related to eligible green projects that meet Green Eligibility Criteria A or Green Eligibility Criteria B below.

|

Green Eligibility |

Assets that have achieved or are expected to achieve any certification or re-certification that falls under the following:

|

|---|---|

|

Green Eligibility |

The purpose of renovation is any of the following environmental improvements:

|

Process for Evaluation and Selection of Projects

GAR obtains the approval of the REIT Executive Committee about the selection of eligible green projects and the use of procured funds for the eligible green projects. GAR then gives advice to GOR on the implementation of green finance. GOR's Board of Directors resolves to implement the green finance based on the advice.

Management of Procured Funds

GOR manages the procured funds in the following ways, if there is any outstanding balance of green bonds issued or a green loan balance under the Framework:

|

Management of upper limit of |

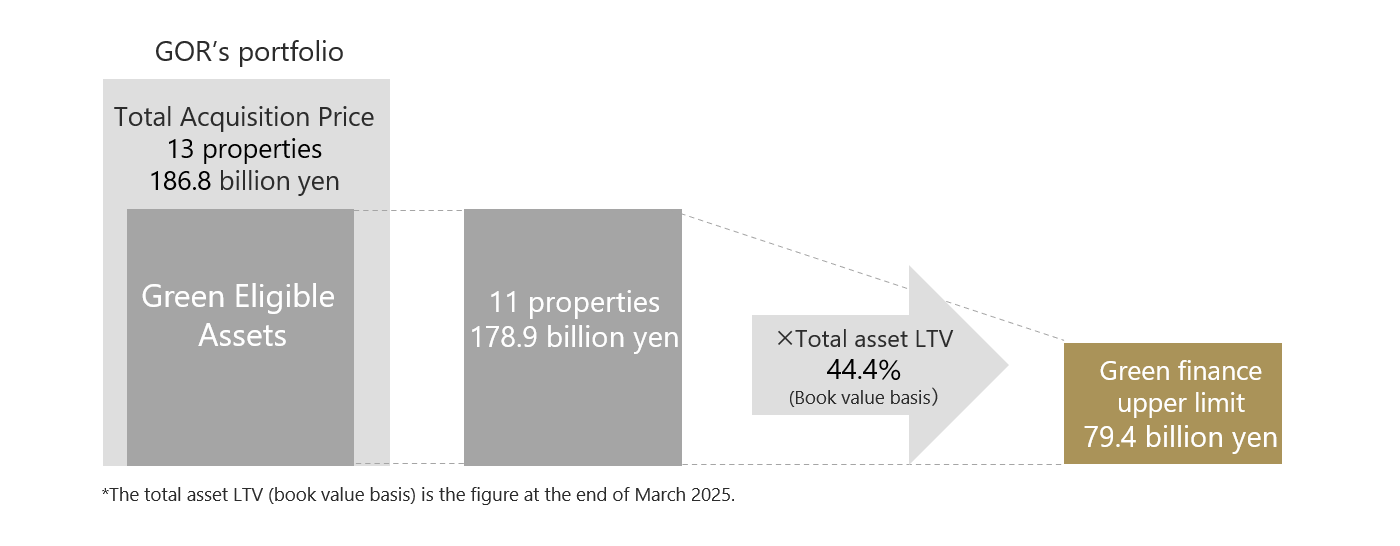

GOR manages the sum of the outstanding balance of green bonds and the green loan balance so that it does not exceed the upper limit of green finance, which is calculated by multiplying the total amount of eligible green projects, the total acquisition price of assets that meet Green Eligibility Criteria A plus the total expenditure for renovations that meet Green Eligibility Criteria B, by LTV (book value at the latest fiscal period end). |

|---|---|

|

Management of |

GOR manages the use of the procured funds for eligible green projects. If there are any procured funds that have not been used, GOR manages the funds as cash or cash equivalents, etc. |

Reporting

GOR discloses the following information about the management of procured funds and the impact of properties it owns on the environment, if there is any outstanding balance of green bonds issued or a green loan balance under the Framework.

|

Reporting of the use of funds |

GOR annually discloses the amounts of procured funds, an outstanding balance of green bonds issued and a green loan balance, and also discloses that all the procured funds are used for the eligible green project under the Framework and that the sum of the outstanding balance of green bonds issued and the green loan balance does not exceed the upper limit of the green finance. If any major events, such as major changes in the plan for the use of procured funds (including the sale of the entire property for which the funds are used) occur, GOR discloses such events in a timely manner. |

|---|---|

|

Impact reporting |

GOR discloses the indicators below as far as practically possible.

|

Allocation of Funds (Fiscal 2024)

As of 31 March 2025

|

Green Finance |

14,850 million yen |

|---|---|

|

-Green bonds |

7,700 million yen |

|

-Green loans |

7,150 million yen |

|

Green Finance Upper Limit |

79,435 million yen |

Green Finance Upper Limit

Issuance of Green Finance

As of 31 March 2025

| Balance (million yen) |

Date Issued | Coupon Rate | Collateral | Maturity Date | Funds Allocated to | |

|---|---|---|---|---|---|---|

| Global One Real Estate Investment Corporation Series No. 14 unsecured bonds (with pari passu clause) (green bonds) (5-year term) | 2,000 | September 27, 2021 |

0.250% | Unsecured Unguaranteed |

September 25, 2026 |

Kinshicho |

| Global One Real Estate Investment Corporation Series No. 15 unsecured bonds (with pari passu clause) (green bonds) (10-year term) | 2,700 | February 25, 2022 |

0.470% | Unsecured Unguaranteed |

February 25, 2032 |

Kinshicho |

| Global One Real Estate Investment Corporation Series No. 16 unsecured bonds (with pari passu clause) (green bonds) (5-year term) | 3,000 | September 27, 2022 |

0.500% | Unsecured Unguaranteed |

September 27, 2027 |

Minami-Aoyama |

| MUFG Bank, Ltd. (Green loan) |

200 | March 31, 2023 |

0.530% | Unsecured Unguaranteed |

March 31, 2026 |

Yokohama |

| The Norinchukin Bank (Green loan) |

1,950 | March 31, 2023 |

0.741% | Unsecured Unguaranteed |

March 31, 2028 |

Yokohama |

| MUFG Bank, Ltd. (Green loan) |

2,500 | March 29, 2024 |

1.186% | Unsecured Unguaranteed |

March 31, 2031 |

Midosuji |

| Meiji Yasuda Life Insurance Co. (Green loan) |

2,500 | March 29, 2024 |

1.206% | Unsecured Unguaranteed |

March 31, 2031 |

Midosuji |

| Total | 14,850 | |||||

-

Kinshicho, Minami-Aoyama, Yokohama, and Midosuji are all properties meeting Green Eligibility Criteria A.

-Kinshicho and Yokohama: CASBEE for Real Estate ‘S rank′ (March 2021)

-Minami-Aoyama: DBJ Green Building certification with a 3-star (September 2019)

-Midosuji: CASBEE for Real Estate ‘S rank′ (February 2022)

Impact Report (Fiscal 2024)

With regard to the acquisition of environmental certification, energy consumption, etc., please refer to ”External Certification” and ”Environmental Performance Record”.