Environmental Initiatives

- Home

- ESG Initiatives

- Initiatives for climate change (TCFD etc.)

- Initiatives for climate change

(TCFD etc.) - Personnel Development Initiatives

- Environmental performance

GOR and GAR’s Awareness of Climate Change

The Paris Agreement adopted in 2015 is a comprehensive agreement that provides an international framework for global warming countermeasures from 2020 onward. Based on an assessment report issued by the IPCC (Intergovernmental Panel on Climate Change), the Agreement stipulated mechanisms for enhancing measures to adapt to climate change and strengthen the required support (e.g., funding, technology), with the aim of keeping the global average temperature rise relative to the pre-Industrial Revolution era fairly low at 2℃ and continuing efforts to limit it to 1.5℃.

Subsequently, the IPCC indicated that, based on the scientific evidence, it would be necessary for greenhouse gas (GHG) emissions worldwide to be zero in real terms (i.e., carbon neutral) by the middle of the 21st century in order to achieve the targets set by the Paris Agreement. Various countries and organizations in agreement with this have set becoming carbon neutral as their long-term target.

The IPCC Special Report on Global Warming of 1.5℃ (published in 2018) indicated that compared with the pre-Industrial Revolution era, the global average temperature had already risen by around 1℃ due to human activity, and its science-based conclusion was that if economic activity remains at the same level, the temperature rise could be expected to reach 1.5℃ as soon as 2030 and around 4℃ by 2050.

GAR recognizes that climate change will lead to drastic changes in the natural environment and social structure and that it is a key issue which will have a major impact on the management and business of both companies. Beginning in fiscal 2022, as one of its materiality action plans, it has set new medium- and long-term targets (for 2030 and 2050) for its greenhouse gas (GHG) emission reduction KPI.

Based on this awareness, GAR aims to improve the resilience of the portfolio owned by GOR with respect to climate change, and it intends to ensure sustainable and stable profits in the long term by identifying the risks and opportunities caused by climate change and reflecting them in the management of both companies and GOR’s investment management principles.

Besides its J-REIT (GOR) management business, GAR is also involved in private fund management business and real estate investment advisory business, but given the nature of investors in these businesses, these initiatives are limited to the J-REIT management business for the moment.

Support for the Recommendations of the TCFD (and Participation in the TCFD Consortium)

GAR newly established the “Climate Change Resilience Policy” in May 2021 and expressed support for the TCFD recommendations in order to clarify the policy and system on initiatives to address climate-related issues and to promote expansion of the disclosure of the content of such initiatives. GAR also joined the “TCFD Consortium”, a group of domestic companies that support TCFD recommendations.

The TCFD is an international initiative established by the Financial Stability Board (FSB) at the request of the G20 Finance Ministers and the Central Bank Governors Meeting to discuss climate-related issues to be addressed by the financial sector. TCFD discusses how financial institutions and companies should disclose the impacts of climate-related risks and opportunities on the organization’s businesses to investors and other stakeholders, and announces recommendations.

The TCFD Consortium was established as a Japanese forum for companies and financial institutions, etc. supporting the TCFD recommendations in order to have discussions on effective disclosure and engagement to link disclosed information to appropriate investment decisions implemented by financial institutions and other organizations.

Given that the environmental issues that climate change will cause for their business represent risks in the medium to long term but may also lead to opportunities at the same time, GOR and GAR recognize that climate change-related information disclosure is essential. Accordingly, after identifying and analyzing climate change-related risks and opportunities in alignment with the TCFD’s recommendations, GOR and GAR will disclose the details and pursue initiatives based on the need to mitigate the impact of their business activities and adapt them to climate change.

Governance

In order to continuously and systematically pursue initiatives based on its ESG policy, GAR has established an ESG Promotion Council that discusses measures to address climate change as a key ESG-related issue.

The council members primarily comprise the executive officers and general managers of relevant departments, with GAR’s President as the top officer. As a general rule, it holds meetings at least four times a year to discuss ESG-related policies, targets, actions plans, and key matters, as well as sharing information about the verification of ESG-related progress, assessment and analysis etc.

Moreover, with regard to activity reporting and future plans relating to ESG, including measures to address climate change, it reports the implementation status of initiatives to GAR’s Board of Directors once per year and also reports on ESG-related budgets and initiatives to GOR’s Board of Directors three times per year as a rule. Based on this system, initiatives to address climate-related issues are supervised by GAR’s Board of Directors and GOR’s Board of Directors.

Strategy

GOR has performed a risk analysis using scenarios based on future temperature changes created by international organizations such as the IEA and IPCC as information sources and considers the business impacts and countermeasures in various cases.

| 1.5℃ Temperature Increase Scenario | 4℃ Temperature Increase Scenario | ||

|---|---|---|---|

| Transition risks | IEA*1 NZE2050 | IEA SPS | |

| Physical risks | IPCC*2 RCP4.5 | IPCC RCP8.5 | |

- International Energy Agency

- Intergovernmental Panel on Climate Change

■What are transition risks?

These refer to risks associated with the transition to a low-carbon or decarbonized economy. They include risks that will impact assets through developments in policies, regulations and technology or the company’s reputation.

■What are physical risks?

Divided into acute risks and chronic risks, these refer to physical damage to assets owned due to the advancement of climate change. Acute risks include damage caused by specific meteorological events such as severe hurricanes, floods, and forest fires, with chronic risks indicating sea level rises, more frequent heatwaves, decreased water supply, etc. due to long-term changes in weather patterns.

■Scenario analysis in line with future temperature rise

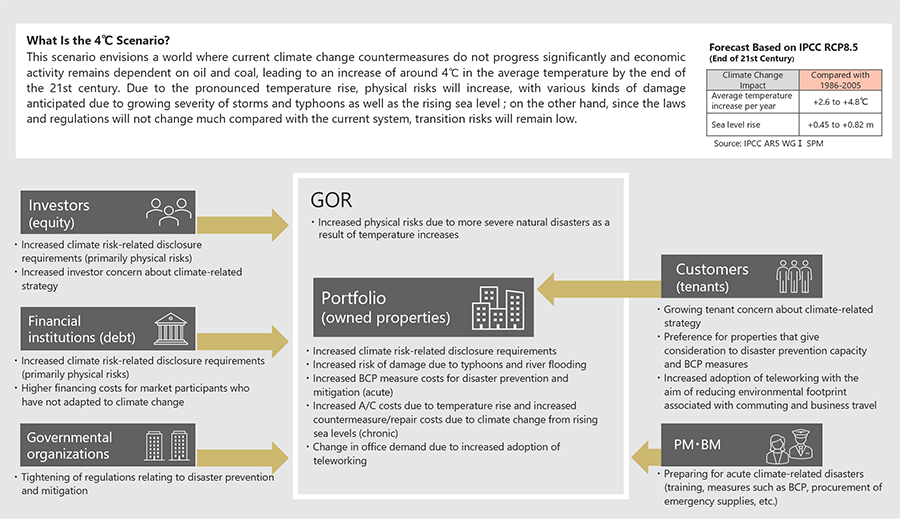

・Projected Global Outlook in 4℃ Temperature Increase Scenario

(Transition Risks: IEA SPS, Physical Risks: IPCC RCP8.5)

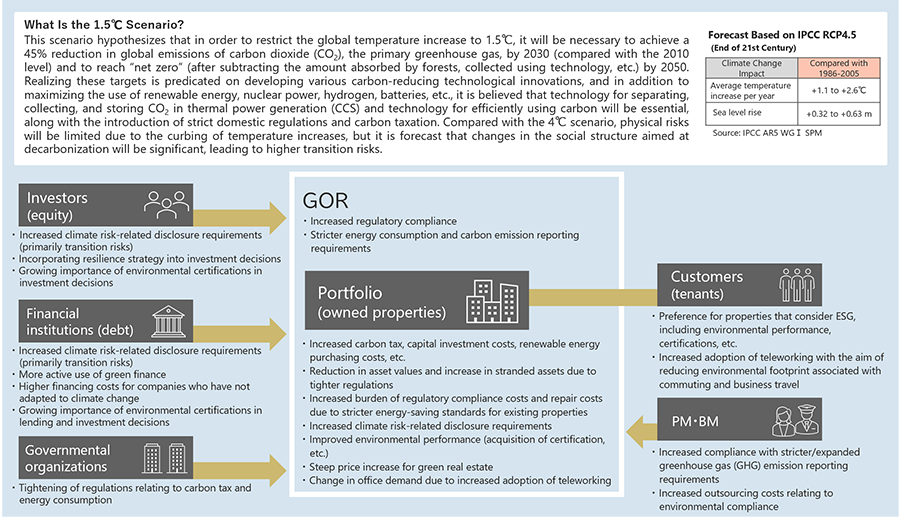

・Projected Global Outlook in 1.5℃ Temperature Increase Scenario

(Transition Risks: IEA NZE2050, Physical Risks: IPCC RCP4.5)

Qualitative Climate Change-Related Assessment (Risks and Opportunities, Financial Impacts, Countermeasures)

| Category | Elements of Real Estate-Related Risks and Opportunities | Potential Financial Impacts | Type | Financial Impact in 4℃ Scenario | Financial Impact in 1.5℃ Scenario | Countermeasures | |||

|---|---|---|---|---|---|---|---|---|---|

| Medium-term | Long-term | Medium-term | Long-term | ||||||

| Transition risks and opportunities | Policy and legal | Introduction of carbon tax and tightening of greenhouse gas (GHG) emission regulations | Increased tax burden and regulatory compliance costs | Risk | Small | Small | Medium | Medium |

・Appropriate management and disclosure of greenhouse gas (GHG) emission targets and performance ・Procurement of renewable energy ・Carrying out energy-saving upgrade work ・Improving environmental certification acquisition rate ・Replacing assets with properties that have excellent environmental performance |

| Enhancement of energy-saving standards for existing buildings | Increased costs for energy-saving upgrades, etc. and regulatory compliance | Risk | Small | Small | Small | Medium | |||

| Increased competitiveness of buildings that comply with laws/regulations | Increased rental income, controlled regulatory compliance costs, and controlled utility costs due to improved energy efficiency | Opportunity | Small | Small | Medium | Large | |||

| Technology | Relative decrease in performance of existing buildings in portfolio due to development and spread of energy-recycling and -saving technology | Increased costs for introducing cutting-edge technology | Risk | Small | Medium | Medium | Medium |

・Collecting information on and

introducing cutting-edge

technologies and services

・Acquisition of ZEB (Net Zero Energy Building) properties |

|

| Reduced utility costs due to improved energy-saving performance | Opportunity | Small | Small | Medium | Medium | ||||

| Market/reputation | Enhanced ESG investment and lending initiatives among investors (equity) and financial institutions (debt) | Fluctuation in NAV and appraisal values | Risk | Small | Small | Small | Small |

・Same measures as “Policy and legal” ・Collecting information on the trend toward appraisals that consider ESG factors |

|

| Opportunity | Small | Medium | Medium | Large | |||||

| Enhanced ESG investment and lending initiatives among investors (equity) and financial institutions (debt) | Improved/worse financing conditions | Risk | Small | Small | Small | Small |

・Same measures as “Policy and legal”

・Appropriate information disclosure and enhanced dialogue ・Maintaining and Improving GRESB assessment results ・Leveraging green finance (e.g., green bonds) |

||

| Opportunity | Small | Small | Medium | Medium | |||||

| Changing tenant needs with regard to energy-saving, net zero emissions, and resilience | Fluctuation in occupancy rates and rental income | Risk | Small | Small | Medium | Large |

・Implementation of PDCA cycle based on tenant satisfaction surveys ・Acquisition of environmental certifications |

||

| Opportunity | Small | Small | Medium | Large | |||||

| Physical risks and opportunities | Acute | Damage to properties due to increased severity of storm and flood damage | Increased repair costs and insurance premiums | Risk | Small | Medium | Small | Small |

・Identifying risks based on hazard

maps

・More sophisticated risk assessment in due diligence process ・Comprehensive BCP (business continuity) measures (both physical and non-physical) |

| Loss of sales opportunities | Risk | Small | Medium | Small | Small | ||||

| Flooding damage due to torrential rain and typhoons (properties non-operational) | Reduction in profits due to move-out of tenants | Risk | Small | Medium | Small | Small | |||

| Chronic | Flooding damage to properties due to sea level rise | Increased costs of dealing with flooding damage | Risk | Small | Medium | Small | Small | ・Identifying risks based on hazard maps

・More sophisticated risk assessment in due diligence process |

|

| Increased A/C load due to rise in average temperature | Increased utility costs and A/C equipment maintenance and repair costs | Risk | Small | Small | Small | Small |

・Introduction of high-efficiency A/C

equipment and appropriate A/C

control

・Enhanced equipment inspection ・Promotion of energy-saving activities with tenants |

||

By implementing the above countermeasures, GAR will strive to minimize the transition risks and physical risks associated with climate change and maximize the opportunities that may be obtained by GOR’s portfolio.

Risk Management

GAR selectively lists GOR’s climate-related transition risks and physical risks in the “Qualitative Climate Change-Related Assessment (Risks and Opportunities, Financial Impacts, Countermeasures)” included in the previous “Strategy” section, and the validity of each item is discussed and verified by the ESG Promotion Council (once a year, as a general rule). Furthermore, these are positioned as key items within the overall ESG-related risks and are managed and monitored (once a year, as a general rule). According to circumstances, the items will also be revised as needed.

In particular, for greenhouse gas (GHG) emission reductions, GAR monitors the status of implementing energy-saving countermeasures, etc. for reaching the targets and the progress of reduction figures, and if required, it considers revising the targets or implementing additional countermeasures. In tandem with this, it will also consider implementing measures to improve the resilience of properties owned by GOR in order to address the anticipated increased severity of natural disasters (flooding due to heavy rains, typhoons, sea level rise, etc.).

Metrics and Targets

Received SBTi* certification

GOR has set new greenhouse gas (GHG) emissions reduction targets in order to achieve net zero emissions by fiscal 2050. These new targets are conformant with the Paris Agreement aim of limiting the temperature increase to 1.5°C, and, as science-based targets, received SBTi certification in fiscal 2023. Going forward, the ESG Promotion Council will perform monitoring every six months to check the degree of progress towards these emissions reduction targets. If there are any significant progress delays, additional measures will be added to plans to reduce GHG emissions and achieve net zero emissions. Furthermore, in fiscal 2024, GOR plans to begin CRREM risk analysis, quantitatively analyze the financial impact of migration risks, and create more concrete transition measures for the years leading up to fiscal 2050.

【Certified GHG emissions reduction targets】

| Target | Base year | Target year | Scope | GHG emissions reduction target |

|---|---|---|---|---|

| Near-Term target | 2022 | 2030 | 1+2 | 42% reduction |

| Net-zero target | 2022 | 2050 | 1+2+3 | Net-zero |

- The SBTi is a joint initiative between CDP, the United Nations Global Compact (UNGC), World Resources Institute (WRI), and the World Wide Fund for Nature (WWF), established in 2015.

The SBTi validates and certifies GHG emissions reduction targets set by companies that are consists with the level required by the Paris Agreement

(aiming to hold the global average temperature increase to a level well below 2°C above pre-industrial levels and pursue efforts to limit the temperature increase to 1.5°C above pre-industrial levels).

TCFD Content Index

| Disclosure Items Recommended by TCFD and Details | Disclosure Location on This Website | |

|---|---|---|

| Governance | Organization’s governance around climate-related risks and opportunities | |

| a) Board oversight of climate-related risks and opportunities | “Governance” | |

| b) Management‘s role in assessing and managing climate-related risks and opportunities | “Governance” “ESG Promotion System“ |

|

| Strategy | Actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning | |

| a) Climate-related risks and opportunities identified over the short, medium, and long term | “Strategy (Qualitative Climate Change-Related Assessment)” | |

| b) Impact of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning | “Strategy (Qualitative Climate Change-Related Assessment)” | |

| c) Resilience of the organization’s strategy, taking into consideration different climate-related scenarios, including a 2℃ or lower scenario | “Strategy (Scenario analysis in line with future temperature rise)”

“Strategy (Qualitative Climate Change-Related Assessment)” |

|

| Risk management | Identification, assessment, and management of climate-related risks | |

| a) Processes for identifying and assessing climate-related risks | “Risk Management“ | |

| b) Processes for managing climate-related risks | “Risk Management“ | |

| c) How processes for identifying, assessing, and managing climate-related risks are integrated into the organization’s overall risk management | ー | |

| Metrics and targets | Metrics and targets used to assess and manage climate-related risks and opportunities | |

| a) Metrics used to assess climate-related risks and opportunities in line with the organization’s strategy and risk management process | “Relationship Between Determined Materiality and SDGs”

“Metrics and Targets“ “Environmental Burden Reduction Goal“ |

|

| b) Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions and related risks | “Environmental Performance“ “Strategy (Qualitative Climate Change-Related Assessment)” |

|

| c) Targets used by the organization to manage climate-related risks and opportunities and performance relative to the targets | “Metrics and Targets“ “Environmental Performance“ |

|

Reduction of Energy Consumption, Greenhouse Gas (GHG) Emissions, Water Consumption and Waste

Concerning initiatives for climate change, efforts to prevent global warming have accelerated around the world following the adoption of Sustainable Development Goals by the UN members in 2015 and the adoption of the Paris Agreement at COP21 in 2015, the first international framework adopted in 18 years since the adoption of the Kyoto Protocol in 1997.

In considering these as being important issues for the business activities of GOR and GAR, as well as for properties under management, we position “reduction of energy consumption, greenhouse gas (GHG) emissions, water consumption and waste” as one of the materialities going forward and seek to contribute to sustainability on the environmental front by reducing environmental burden through continuous reduction.

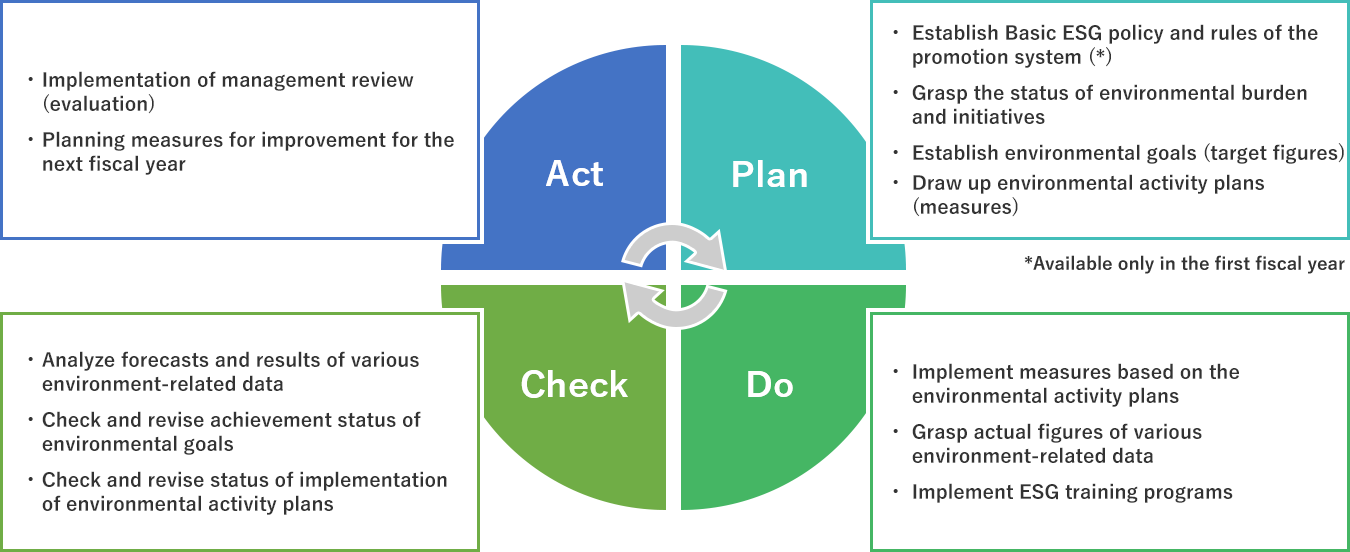

System to Promote Reduction of Energy-Related Consumption and PDCA Cycle [Environmental Management System (EMS)]

In order to realize environmental sustainability, we established our own Environmental Management System (EMS) to address various issues and have operated and managed the system through the ESG Promotion Council.

EMS based on the PDCA cycle (image)

Revisions to the Environmental Management System (EMS) Operating Manual

In March 2024, the Environmental Management System (EMS) manual was revised with an eye toward certification and registration under the Ministry of the Environment's EcoAction 21 program.

Environmental Burden Reduction Goal

| Item | Goal*1 | |

|---|---|---|

| Greenhouse gas (GHG)*2 | GHG emissions (total emissions) |

Near‐Term target*3:42% reduction by fiscal 2030 |

| Net-Zero target*3:Realization of net zero emissions by fiscal 2050 | ||

| Energy (electricity, fuel, district heating and cooling) | Intensity | 10% reduction by fiscal 2030 |

| Water | Intensity | 2% reduction by fiscal 2030 |

| Waste | Recycling rate | 1% increase by fiscal 2030 |

- All targets are in comparison to fiscal 2022. Energy, water, and waste reduction targets for the years up to fiscal 2023 were in comparison to fiscal 2018, and consumption intensity reduction rates (and, in the case of waste, waste recycling rates) were measured. Both energy and water reduction targets were achieved in fiscal 2023, five years after the base year of 2018, so from fiscal 2024, the reduction targets were changed, using fiscal 2022 as the new base year. For waste, a 10-year target for fiscal 2028 had been set for improving the waste recycling rate. After reviewing the base year of 2018, the base year for this was also changed to fiscal 2022.

- SBTi certification was acquired in fiscal 2023, so reduction targets were redefined. This item is limited to CO2 emissions intensity from energy.

- SBTi certification was acquired.

- The coverage rate within portfolio upon the calculation of the above data is 100%.